The Four Benefits of AI for Insurance Analytics

Written by GoodData Author |

For insurers, introducing artificial intelligence (AI) can yield numerous benefits beyond the typical time and cost reductions. Insurers that capitalize on this technology will emerge as industry leaders—while those who don’t will find themselves lagging behind. As I outlined in Claims Journal, AI is a critical part of insurance analytics and a digital insurance strategy, and it delivers four major benefits for insurers.

AI Delivers Increased Access to Data and Insights

Introducing AI into a workflow requires companies to build a better, more accurate data foundation, and that improvement starts to help employees before AI is even used. Let’s consider an employee who is trying to determine if particular customers are spending too much time in the service center especially if they have a low expected lifetime value. With access customer journey analytics and insights, the underwriter is provided with a predicted lifetime value score and is able to use this to drive a better pricing decision. Once AI is introduced, any actions previously taken and the customer’s information can be sent to the machine-learning model to improve future outcomes and ensure that the sales and marketing teams are targeting the most profitable customers—and avoiding those likely to be unprofitable.

The Right Insights are Delivered to the Right People at the Right Time

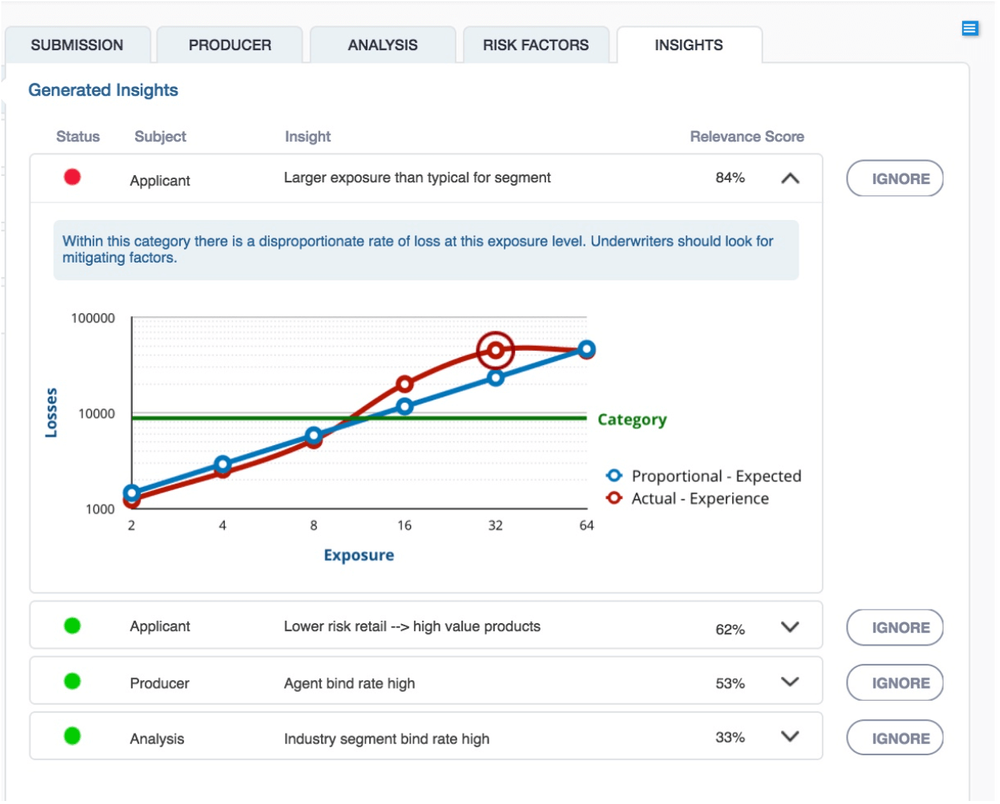

When a submission is sent to underwriting, it’s first scored against predictive models in real time for areas like “broker sincerity” or “projected loss ratio for this class.” AI can then create a ranking system for those submissions, helping to answer questions like “Which risk should I work on next that will be most advantageous for our company?” Digitizing the underwriting process with AI therefore enables the underwriter to determine the best course of action based on the insights presented. In this case, AI helps bridge the gap between the insight and the action taken by the employee based on the recommendation provided by the AI engine.

AI Recommendation: Exposure higher than normal, suggest surcharge to standard premium

AI Ensures Consistent Employee Performance

Because AI eliminates much of the guesswork associated with decision-making, decisions become more accurate, correct, and consistent. While training is still a necessary component, using AI helps less experienced employees get up to speed much faster—because they’re getting recommendations based on past decisions that have been validated at their point of work—and it eliminates much of the risk associated with a new employee. While a less experienced adjuster may overcompensate a customer for a claim, AI can guide an adjuster through recommended next steps based on past experience, all within the system in which they are working.

Employees Make Faster, Better, Data-Driven Decisions

Consider an insurance company trying to fight fraud. Because AI can use historical data on fraudulent claims to improve its understanding of typical fraud patterns, future fraud is identified much faster and more accurately than is possible for a human to discern. When a fraudulent pattern is recognized, the claim is immediately routed to the Special Investigations Unit (SIU), and the feedback obtained from the final dispensation of the claim enables the fraud models to continuously improve by becoming smarter and more accurate with each new claim referred to the SIU.

When taking into account the benefits outlined above, it’s clear that insurance companies should be looking to incorporate AI into the daily workflow of the claims department. By making embedded analytics more pervasive, delivering the right insights to the right people, helping all employees perform like experts, and enabling faster, more data-driven decisions overall, AI will help insurance companies to clearly differentiate themselves from their competitors and become more efficient and profitable .

Written by GoodData Author |